An important explore circumstances is to remove token transfer surgery to have active pages and you may liquidity team. Inside V3, whenever a user adds liquidity, takes away they, otherwise claims charges, it begin an ERC20 token import, and that costs fuel. Uniswap v4 introduces an energetic percentage program one automatically changes so you can field conditions.

Instead of recognizing a bid from one origin, swaps experience a market system. “Fillers” usually compete to discover the best route that offers an educated rate for swappers. View it while the Uniswap that have plug in the issues titled hooks, just one common offer one reduces energy, and you will systems to help you batch actions effortlessly. We feel the best design to have thumb bookkeeping uses “transient stores,” which could getting enabled from the EIP-1153. It EIP is thought to be the main Ethereum Cancun hardfork and can provide a great deal larger gas advancements and you will vacuum cleaner deal habits round the numerous programs.

Observe that assistant agreements used for evaluation try kept in the new v4-core/src/test subfolder within the src folder. People the newest try helper contracts might be additional here, when you’ Uniswap exchange re all of the Foundry tests have the fresh v4-core/test folder. The fresh insect bounty stays active in order to remind lingering defense lookup, password analysis, and you can revealing of every things just after deployment. Governance should be able to choose to add a protocol percentage to virtually any pond, up to a great capped matter.

For many who consider list their token for the Uniswap V4 we could help you create the brand new pool for the trade couple or update of lower versions (V1, V2, V3). The brand new changeover to ERC-6909 produces exchangeability administration much more prices-energetic and representative-amicable. The newest standard triumphs over the key restrictions from ERC-721, reducing too many gas can cost you and you can broadening resource management potential. Inside the previous versions away from Uniswap, charge had been rigidly put from the 0.05%, 0.3%, or step 1%, dependent on advantage exposure and kind.

Empirica – their guide and you can liquidity vendor to the Uniswap V4 – Uniswap exchange

Having a flexible percentage framework, strong defense, and you can expansions for the NFTs and you will multiple organizations, Uniswap continues to head just how inside decentralized financing. Growing away from Uniswap V2’s first exchanges in order to V3’s focused exchangeability now the newest following V4, which pledges far more adjustment and lower fees, Uniswap continues to lead just how inside DeFi. Flash Bookkeeping and you may Singleton Deals as well as get rid of operational will set you back, making it simpler for LPs to participate several pools which have down financing.

We’ll apply a features to accept the newest Universal Router to spend tokens for the deal. They outsources the challenge of understanding an informed path to a competitive marketplaces that is aware of most other onchain provide and private directory discover swappers an informed rates. Uniswap v1 is an experiment inside liquidity production to test if the AMMs got a location inside the crypto.

step 3 Flash Bookkeeping

Since the unveiling inside 2017, Uniswap has gone because of about three types, and we’lso are excited to see the brand new next. Uniswap V1 already been since the a simple automated industry inventor (AMM), where deals are only able to be made that have ETH among the new tokens in the some. V3 introduced concentrated liquidity, letting liquidity organization lay particular price ranges due to their money, putting some system more effective. Uniswap v4 raises vibrant charge, an even more receptive and flexible system. Allowed by the hooks, pond founders can also be apply customized logic to modify swap charges centered to the people to the-strings variable, such industry volatility or change frequency.

Moreover it brings up a complete likewise have varying to trace minted and you may burnt tokens, gaining high-volume traders and you can exchangeability team by permitting tokenized states. Concurrently, thumb accounting optimizes purchases by the upgrading internal balance very first and you may doing final transfers at the end. The introduction of “hooks”, singleton deal and you can thumb accounting can result in increased overall performance inside the deal routing. So it facilitated arbitrage and you can give agriculture options instead of demanding initial investment. Uniswap try an growing DEX protocol enabling anyone with a great crypto handbag to shop for, sell, and you may swap numerous digital property. The platform provides let a new category of LPs to make charge on the lazy possessions when you’re allowing buyers to without difficulty swap between cryptocurrencies.

The newest Singleton deal only status the brand new customer’s inner balances inside the container. An authentic token transfer is just expected if the affiliate wants to maneuver its possessions out from the Uniswap v4 system completely. So it dramatically decreases the cumulative fuel charges for repeated traders and exchangeability company.

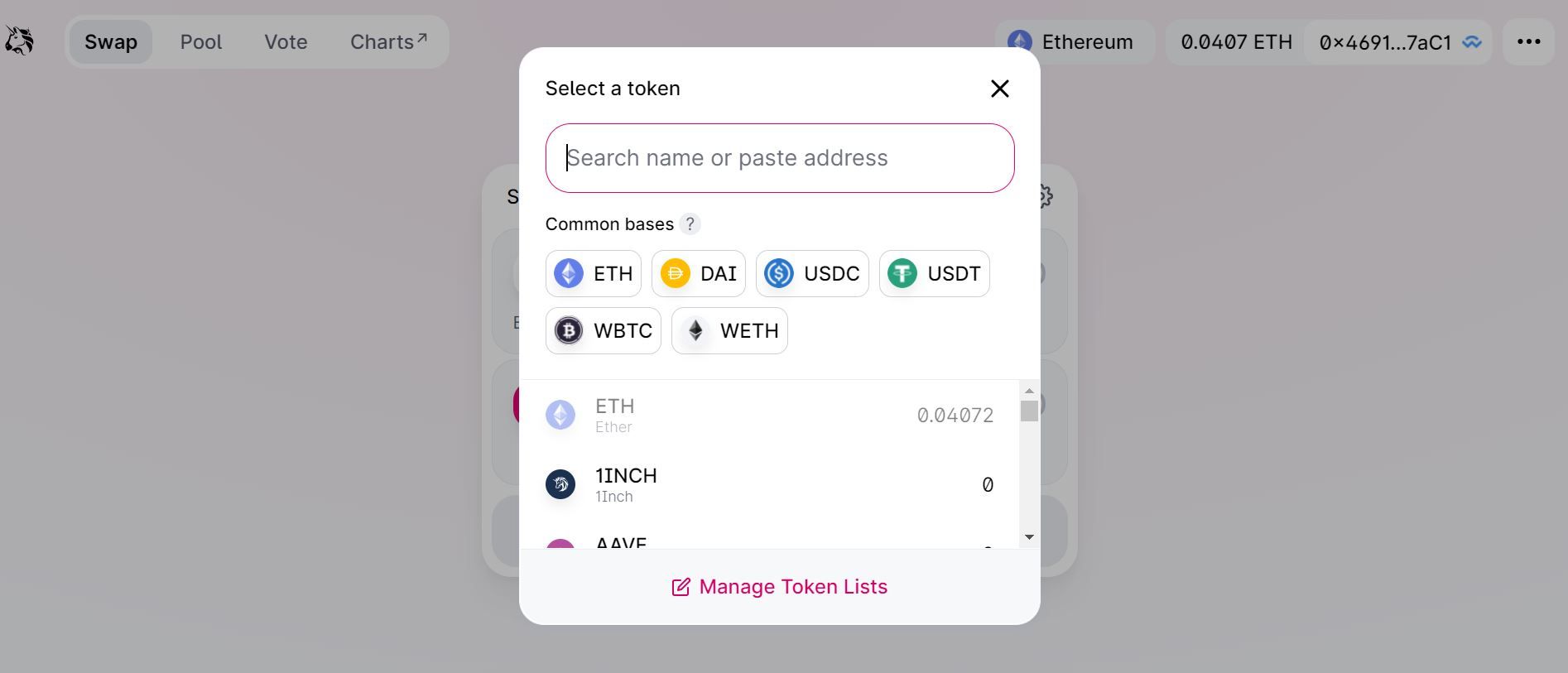

Those who have exchanged brings due to broker businesses would be common having your order book system. Once you have linked the wallet, you can purchase the tokens we should change. You might pick from an array of tokens, possibly by navigating on the token facts page, or going into the token myself. This allows the fresh person of one’s form to understand exactly how of many tokens was acquired from the exchange.

However, v3 however holds an edge in the strong exchangeability, and many people and you will LPs will get like its fixed commission structures and you can centered ecosystem. For now, v4 ‘s the upcoming, however, v3 and you can v2 however serve particular demands, so your decision might be considering your trading layout and exchangeability approach. Now, Uniswap v4 raises ERC-6909, a light and a lot more gasoline-effective token fundamental that can help liquidity company and you can investors spend less on charges by reducing so many outside calls. All of the trading or liquidity changes within the earlier incarnations needed multiple ERC-20 transfers, which improved fuel can cost you unnecessarily. Uniswap V4 lets for each and every-exchange, block-founded, otherwise arbitrary day-centered commission alterations, optimizing costs on the market requirements.

How to include Uniswap 4 and build customized hooks

Uniswap v3 got a robust, opinionated approach to liquidity provision, controlling an extremely state-of-the-art tradeoff space. Such as, v3 enshrined oracles, making it possible for builders in order to include genuine-date, onchain rates investigation, but at the expense of certain improved prices for swappers. The brand new Uniswap V4 inform represents a serious revolution regarding the progression out of decentralized money. With its innovative provides, optimal performance, and you may increased security, Uniswap V4 try positioned to put the brand new conditions on the DeFi environment. Regardless if you are a trader, a designer, or a casual representative, Uniswap V4 also provides exciting possibilities to build relationships the ongoing future of financing.

Initializing a share in the V4

This way, the working platform stays decentralized when you are making sure regulating conformity, making it easier to possess institutional people to interact safely in the DeFi. Industry volatility can lead in order to shorter efficiency or impermanent losses to possess exchangeability team. The brand new Active Commission Changes connect remedies so it by changing costs based to the business requirements, enhancing productivity through the volatile periods, and possibly handling LVR and you may MEV issues. Past customizability, Uniswap v4 brings gasoline offers for both swappers and you will LPs. Undertaking the fresh pools with v4 can be 99.99% less expensive than inside earlier incarnations, and swappers should expect gasoline offers to your multi-jump exchanges.

Uniswap V4 means a critical step forward in the DeFi ecosystem from the starting alteration thanks to hooks, enhancing overall performance which have a good singleton architecture, and you can enabling a variety of innovations. It addresses pressures including large fuel fees, and then make DeFi a lot more obtainable and value-active to possess pages. With hooks during the the core, Uniswap V4 brings a material to own DeFi developers so you can painting their book eyes from decentralized financing. The capability to create custom exchangeability swimming pools which have bespoke has and tips opens a realm from in past times unimaginable alternatives.